Insights

Videos and Articles

Entity Type:

Content Type:

Industry:

Service:

- All

- Audit

- Business Tax

- Cloud Computing

- Compensation and Benefits

- Credits and Incentives

- Data and Analytics

- Employee Benefit Plans

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Investigations

- Indirect Tax

- International Tax Planning

- Managed Services

- Private Client

- Private Client Services

- State and Local Tax

- Tax

- Technology Consulting

- Wealth Management

Topic:

- All

- Artificial Intelligence

- Blockchain

- Career Blog

- CARES Act

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity and Data Breach

- Digital Assets

- Digital Goods

- Economics

- Election 2020

- Employee Benefit Plan Services

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- Labor and Workforce

- Nexus

- Online and Remote Seller Sales Tax

- Partnership

- Payroll and Employment

- Policy

- Regulations and Compliance

- Regulatory Compliance

- S Corporation

- SEC Matters

- Supply Chain

- Tax Reform

Lessor accounting under ASC 842

Our whitepaper explains contracts within the scope of Topic 842, as well as a lessor's accounting under ASC 842 for its contracts that are (or include) leases.

Producer prices rebound, keeping pressure on Fed to raise rates

The producer price index rose by 0.4% in September after falling for two straight months, the Bureau of Labor Statistics reported on Wednesday.

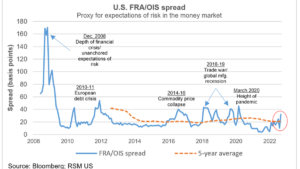

Amid global economic turmoil, stress grips fixed-income markets

Fixed-income markets are signaling a shift in perceptions of financial stability and raising a caution flag for investors.

Economic headwinds: Oil and gas sector

RSM examines what economic headwinds mean for the oil and gas sector, which is faring better than the overall economy.

How the Student Loan Debt Relief Plan works

President Biden announced a plan to extend the pause on student loan repayments and offer student loan forgiveness to millions of borrowers. Under the Student Loan Debt Relief Plan, eligible borrowers will have up to $20,000 of their student loans forgiven. Watch this video to learn more about the program.

10 issues that affect wealth preservation and what you can do about them

Wealth preservation issues and strategies for multigenerational wealth; how to prioritize grantor intent for future generations while minimizing taxes and reducing conflict.

The Clean Vehicle Tax Credit Program

The Inflation Reduction Act includes the Clean Vehicle Tax Credit program which provides tax credits for purchasing electric vehicles. Learn about the tax credits and limits on qualifications.

The new corporate minimum tax: overview and highlights

The Inflation Reduction Act of 2022 imposed a new 15% alternative minimum tax on large corporations. Notably, the tax is based on a corporation’s financial statement income (with adjustments).

Research and Development Tax Credits

While most companies expense the cost of research and development activities, most fail to take advantage of the R&D tax credit. Learn how the tax credit works and what expenses qualify for it.

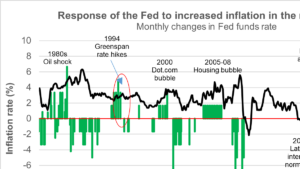

FOMC policy decision: Fed hikes policy rate by 75 basis points

At this critical juncture, with the policy rate residing in neutral terrain, it is natural for the Fed to adjust its rhetoric as it considers next steps.

Overview and Benefits of a Stock Option Plan

A stock option plan can be used to align the interests of employees and shareholders, and attract and retain talented workers. This video will cover the basics of a stock option plan and how your company may benefit from having one.

U.S. June CPI: Persistent top-line inflation hits 9.1%

The top-line consumer price index hit 9.1% in June on the back of a 11.2% increase in gasoline prices and a 7.5% jump in overall energy prices.

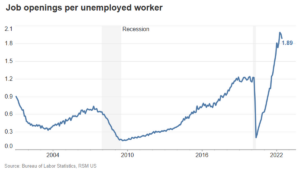

Job openings show signs of a slowdown

Job openings declined for the second straight month in May as the Federal Reserve's rate hikes slowed down overall demand.

Preparing Your Business for a Recession

A recession can be challenging for any business. However, business owners can take steps to prepare for a recession and position their companies for growth as the economy recovers. In this video, we'll provide six tips to help you and your business prepare for a recession.

Fed announces largest rate hike in nearly three decades as it seeks to restore price stability

The Federal Reserve lifted its federal funds policy rate to a range between 1.5% and 1.75% on Wednesday as it moves to restore price stability over the medium term.