Insights

Videos and Articles

Entity Type:

Content Type:

Industry:

Service:

- All

- Audit

- Business Tax

- Cloud Computing

- Compensation and Benefits

- Credits and Incentives

- Data and Analytics

- Employee Benefit Plans

- ERP and CRM

- Federal Tax

- Financial Advisory

- Financial Investigations

- Indirect Tax

- International Tax Planning

- Managed Services

- Private Client

- Private Client Services

- State and Local Tax

- Tax

- Technology Consulting

- Wealth Management

Topic:

- All

- Artificial Intelligence

- Blockchain

- Career Blog

- CARES Act

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity and Data Breach

- Digital Assets

- Digital Goods

- Economics

- Election 2020

- Employee Benefit Plan Services

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- Labor and Workforce

- Nexus

- Online and Remote Seller Sales Tax

- Partnership

- Payroll and Employment

- Policy

- Regulations and Compliance

- Regulatory Compliance

- S Corporation

- Supply Chain

- Tax Reform

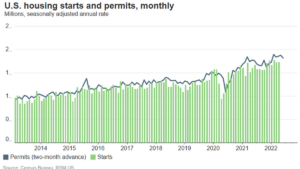

Chart of the day: U.S. housing starts fall amid rising mortgage rates

Housing starts fell by 0.2% on the month to 1.724 million annualized, according to the U.S. Census Bureau.

Supreme Court sweeps away rule in tax collection due process practice

Internal Revenue Code section 6330(d)(1)'s 30-day time limit to file a petition for review of a collection due process case is not a jurisdictional deadline and is subject to equitable tolling.

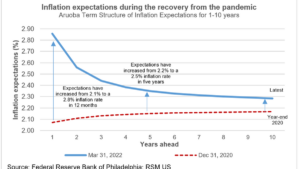

The price of war: Risks around the inflation outlook

While we expect the annual inflation rate to peak this quarter as the comparisons to the lower levels of a year ago wear off, the risk of rising prices will remain.

Succession Planning for Nonprofits

Grooming future leaders and mapping out a succession plan in advance is one of the best ways to mitigate the risk of losing key personnel and prepare for the future needs and growth of an organization. This video offers tips and best practices for creating and implementing a succession plan for your nonprofit.

RSM US Supply Chain Index: Bracing for more disruptions

Widespread lockdowns in China and prolonged geopolitical conflict in Ukraine will most likely assure another round of supply chain snarls ahead.

Chart of the day: Manufacturing grew at a slower rate in April

Manufacturing grew at a slower rate in back-to-back months as labor shortages continued to hamper production while demand moderated from January's high.

3 things to know before raising your prices

With rising prices proving to be stickier than expected, business leaders have been facing a challenge: how to set prices in a highly inflationary environment.

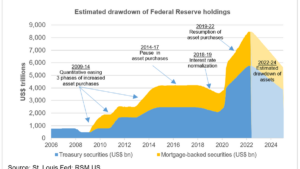

FOMC preview: Rate hikes and balance sheet reduction are up next

Next week’s Federal Open Market Committee meeting will kick off an extraordinary two months of policy decisions by the Federal Reserve in which we expect the…

Chart of the day: U.S. home prices hit record in March

Sales of existing homes fell by 2.7% to 5.77 million in March, the lowest since July 2020, as rising mortgage rates dampened demand.

Interest rate update: Confidence in the Fed, but uncertainty over long-term growth

The Federal Reserve has started to normalize interest rates, lifting the short-term transaction cost off the zero bound. The result has been a 100-basis point…

The tax and trade implications of new legislation targeting Russia

A new law suspends Russia's preferential trade status, and a separate proposal would deny foreign tax credits and certain deductions for U.S. companies earning income in Russia.

Nebraska enacts corporate and personal income tax rate cuts

Following up on corporate cuts made in 2021, Nebraska phases-in several years of both corporate and personal income tax rate reductions.

Accounting for obligations to safeguard crypto-assets

SAB 121 includes guidance for entities that have obligations to safeguard crypto-assets held for their platform users.

Retail sales slow in March as inflation takes a toll

March's retail sales added substantial downside risks to our forecast for economic growth that will most likely dip below 1% in the first quarter.

Inflation marches higher, hitting 8.5% compared to a year ago

Long ago and far away, it was once taught that inflation has long and variable lags. That still probably applies when setting policy, managing a portfolio or…