Insights

Videos and Articles

Entity Type:

Content Type:

Industry:

Service:

- All

- Audit

- Business Tax

- Cloud Computing

- Compensation and Benefits

- Credits and Incentives

- Data and Analytics

- Employee Benefit Plans

- ERP and CRM

- Federal Tax

- Financial Advisory

- Financial Investigations

- Indirect Tax

- International Tax Planning

- Managed Services

- Private Client

- Private Client Services

- State and Local Tax

- Tax

- Technology Consulting

- Wealth Management

Topic:

- All

- Artificial Intelligence

- Blockchain

- Career Blog

- CARES Act

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity and Data Breach

- Digital Assets

- Digital Goods

- Economics

- Election 2020

- Employee Benefit Plan Services

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- Labor and Workforce

- Nexus

- Online and Remote Seller Sales Tax

- Partnership

- Payroll and Employment

- Policy

- Regulations and Compliance

- Regulatory Compliance

- S Corporation

- Supply Chain

- Tax Reform

When To Outsource Your Accounting

Thanks to the cloud and automation, outsourcing has never been a more viable option than it is today. Quite often, outsourcing can be more efficient and less expensive than hiring dedicated staff. In this video, we'll cover the benefits of outsourcing your accounting.

U.S. October CPI: Inflation still high, but relief on the horizon

inflation is most likely approaching an inflection point where the central bank can begin considering a pause in its efforts to restore price stability.

Five Steps to Recognizing Revenue in Financials

The FASB and IASB have provided standards for properly recognizing revenue in your financials. Using a five step process, companies recognize revenue based on the value and timing of when control of the goods and services are transferred to the customer. Learn about the standards and how to properly recognize revenue for your company.

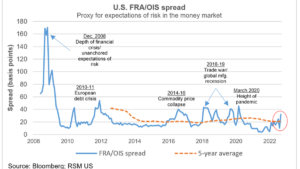

Fed raises its policy rate by 75 basis points as it prepares to slow pace of hikes

The Federal Reserve increased its policy rate by 75 basis points on Wednesday to a range between 3.75% and 4% as it hinted at slowing the pace of its hikes.

IRS makes statements on CARES Act Employee Retention Tax Credit risks

On Oct. 19, 2022 the IRS issued a news release warning employers to be wary of third parties who have ramped up campaigns to try and get employers to claim the CARES Act Employee Retention Tax Credit (ERTC) when they may not actually qualify.

What Is an S-Corp Election?

Business owners often struggle with determining the optimal legal structure and tax treatment for their business. This video will explain an S-Corp tax election and how it may benefit you and your business.

IRS releases 2023 tax inflation adjustments

IRS releases inflation adjustments for 2023. Inflation adjustments impact individual tax brackets and other various provisions of the Code.

Expect More IRS Audits

The Inflation Reduction Act allocated $80 billion to the IRS for hiring additional personnel and improving processes and technology. Learn how this might affect future audit activity and how much time the IRS has to audit you.

Lessor accounting under ASC 842

Our whitepaper explains contracts within the scope of Topic 842, as well as a lessor's accounting under ASC 842 for its contracts that are (or include) leases.

Producer prices rebound, keeping pressure on Fed to raise rates

The producer price index rose by 0.4% in September after falling for two straight months, the Bureau of Labor Statistics reported on Wednesday.

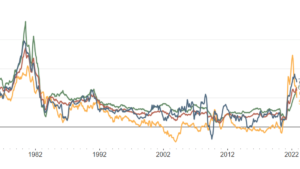

Amid global economic turmoil, stress grips fixed-income markets

Fixed-income markets are signaling a shift in perceptions of financial stability and raising a caution flag for investors.

Economic headwinds: Oil and gas sector

RSM examines what economic headwinds mean for the oil and gas sector, which is faring better than the overall economy.

How the Student Loan Debt Relief Plan works

President Biden announced a plan to extend the pause on student loan repayments and offer student loan forgiveness to millions of borrowers. Under the Student Loan Debt Relief Plan, eligible borrowers will have up to $20,000 of their student loans forgiven. Watch this video to learn more about the program.

10 issues that affect wealth preservation and what you can do about them

Wealth preservation issues and strategies for multigenerational wealth; how to prioritize grantor intent for future generations while minimizing taxes and reducing conflict.

The Clean Vehicle Tax Credit Program

The Inflation Reduction Act includes the Clean Vehicle Tax Credit program which provides tax credits for purchasing electric vehicles. Learn about the tax credits and limits on qualifications.